The Times reports that pedophile Jeffrey Epstein earned more than $100 million from private equity magnate Leon Black in exchange for providing some “idea-generator”-type tax advice on a handful of Black’s family trusts, advice that Black still had to pay his own tax lawyers to implement.

Does that mean that Epstein, who was a college dropout, was a self-taught tax genius? Not likely.

But it does suggest that Epstein knew the value of personalized pricing. Here’s the key passage from the article:

Jack Blum, a Washington lawyer who has led corruption investigations for several Senate committees, said he was surprised by the size of the fees Mr. Epstein’s work commanded. “You could be the best lawyer in Manhattan working on the most complicated trusts and estates and it would never come anywhere close to that kind of money,” he said.

Matthew Goldstein & Steve Eder, What Jeffrey Epstein Did to Earn $158 Million From Leon Black, N.Y. Times (Jan. 26, 2021).

So what gives?

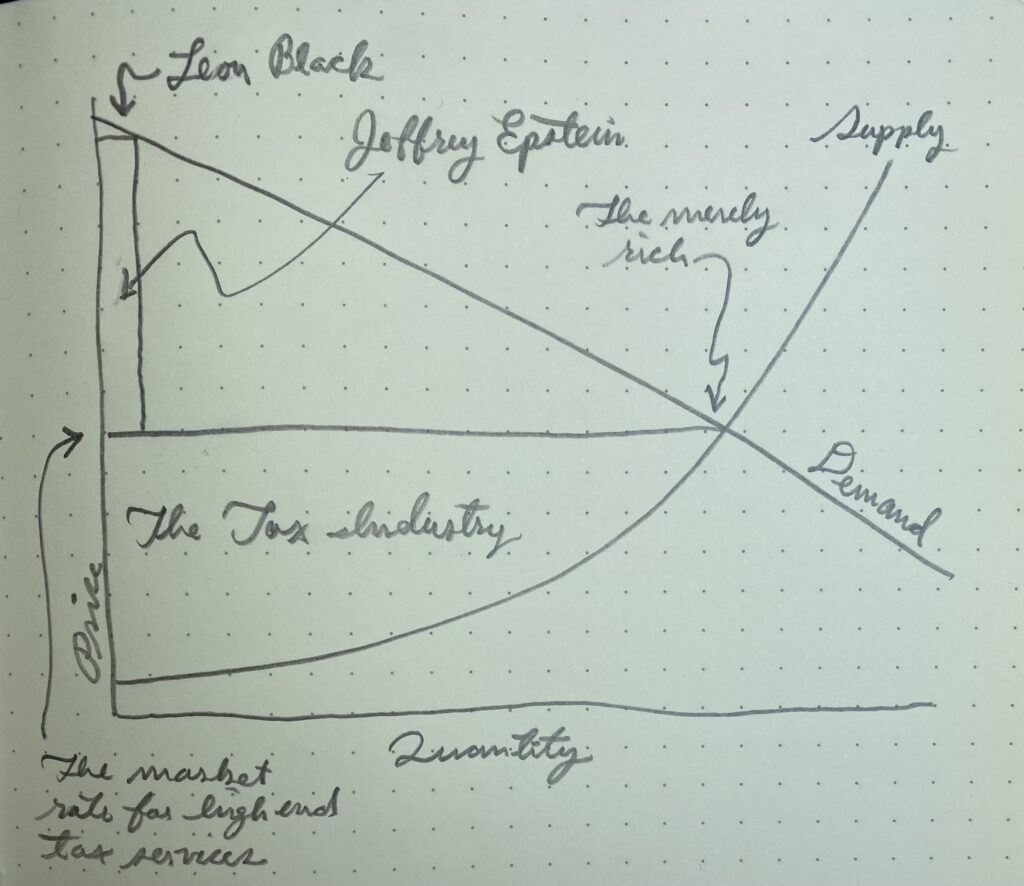

The answer is that tax lawyers price for the marginal consumer: the marginal client using their services. They not only serve magnates like Leon Black, but also the merely rich, like an executive mentioned in the Times article whom Epstein initially refused to take on as a client for being insufficiently wealthy.

The merely rich can’t afford $100 million, so, to get their business, tax lawyers must charge them lower fees. When the truly rich, like Leon Black, go looking for tax advice, they knock on these lawyers’ doors, and the lawyers charge them about the same price they charge everyone else.

They don’t try to charge higher fees to their wealthiest clients because tax law is a reasonably competitive industry. You need to be smart to work at the high end of the field, but tax is not a field in which “the best are easily ten times better than the average.”

And for the many who do have what it takes, the cost of entry into the market is relative low; all you need is a JD and an LLM, which cost a few hundred thousand dollars to obtain, about the amount needed to open a cleaners or a pizzeria (okay, there’s also the opportunity cost of time spent in school, but we are still probably only talking about the high six figures).

So if you start raising your fees above what the marginal client is willing to pay, your super-rich inframarginal clients will take their business to another tax lawyer who is still pricing for the marginal client. So you, too, continue to price for the marginal client.

But what if you could find a way to charge your richest clients prices personalized to them, and not have them jump ship to your competitor?

It looks like Epstein’s grift was figuring out how to do that.

The answer, as in so many other lines of business, was to make tax advice into a luxury product: to make the product exclusive.

The Times tells us that Epstein sold himself to clients as a genius who would only give tax advice to the richest of the rich. He cultivated the image of being, not some pathetic, overworked, upwardly-mobile professional, but one of them, a fellow member of the super-rich who was willing to cut other members in on secrets that only they could access because of who they were.

Exclusivity creates brand loyalty, and brand loyalty means that you stop shopping around; you are willing to pay a price determined by what you can afford, rather then what competitors are offering. You are willing to pay, in other words, a personalized price.

Graphically, the tax market may have looked like this:

Gerrit De Geest observes in Rents: How Marketing Causes Inequality, that in today’s economy, it’s not those who make who earn all the profits, or those who distribute who earn all the profits; it’s those who do the marketing. That’s where all the rents live. Competition drives profits to zero for all save those who beguile.

It seems somehow fitting that this economy would spawn a figure like Epstein, who sold tax advice but didn’t even bother to do his legal work in house. He didn’t really sell tax advice; he marketed it.

As the Times recounts, Epstein referred one acquaintance to outside tax lawyers, whom the acquaintance then paid for tax advice, and then Epstein, having never mentioned a fee to this acquaintance, sent him a bill for 10% of the purported tax savings that the lawyers, and not Epstein, had created.

That 10% was the price of enchantment, nothing more.

But you still have to wonder how a private equity guy like Black, whose business revolves around deals hammered out by armies of lawyers and shaped by tax considerations, could have thought he was getting something special from Epstein.

Did he really think tax was like music, and it was worth paying his Mozart to dream up a tune, even if Black still had to pay someone else to write all the notes down for him?

Maybe he didn’t, and there’s more left to tell in this story.

Or maybe we need a new razor: Never attribute to conspiracy what can otherwise be attributed to marketing.