First we thought the inherent superiority of our political system would defeat the Chinese Communist Party. Now that we’re coming to terms with the fact that it didn’t, we seem to think that the inherent superiority of free markets will defeat China instead.

Clearly, we’re not taking learning in account.

But I don’t mean that we haven’t learned from our mistaken view that China would become more democratic as it became wealthier.

I mean that in assuming that China’s embrace of a new closed door policy will cause its technological competitiveness to wither, we are literally failing to take the relationship between learning and output into account.

The Wall Street Journal argues that by picking fights with the West, and getting itself banned from engaging in semiconductor trade with the US as a result, China has put itself in the deeply wasteful position of having to recreate a native semiconductor industry from scratch. If the moonshot fails, Chinese high tech firms will lag, and the country’s race to global dominance will be lost.

It would have been much better, argues the Journal, for China to have continued to make nice with the West and enjoy the benefits of trade, not least of which is the ability to leverage what others do best—like making semiconductors—to enable China to do what it does best—like making smartphones and 5G infrastructure.

The Achilles heel of this and all free trade arguments is that they don’t take innovation into account, and specifically that most valuable of all forms of innovation: learning by doing.

The fact that China is not an efficient producer of semiconductors today, and would be better off trading with those who are, does not mean that China cannot learn to be an efficient producer of semiconductors tomorrow.

And if China is able to learn, then the money it pours into starting more or less from scratch now won’t be wasted.

Instead, it will be the most important investment China has ever made, because it will buy not only a valuable skill, but something more valuable still: independence and a shot at world domination. The future belongs to high tech, the hardest thing to do in high tech is chips, and so if you’ve got the best chips, you will win eventually.

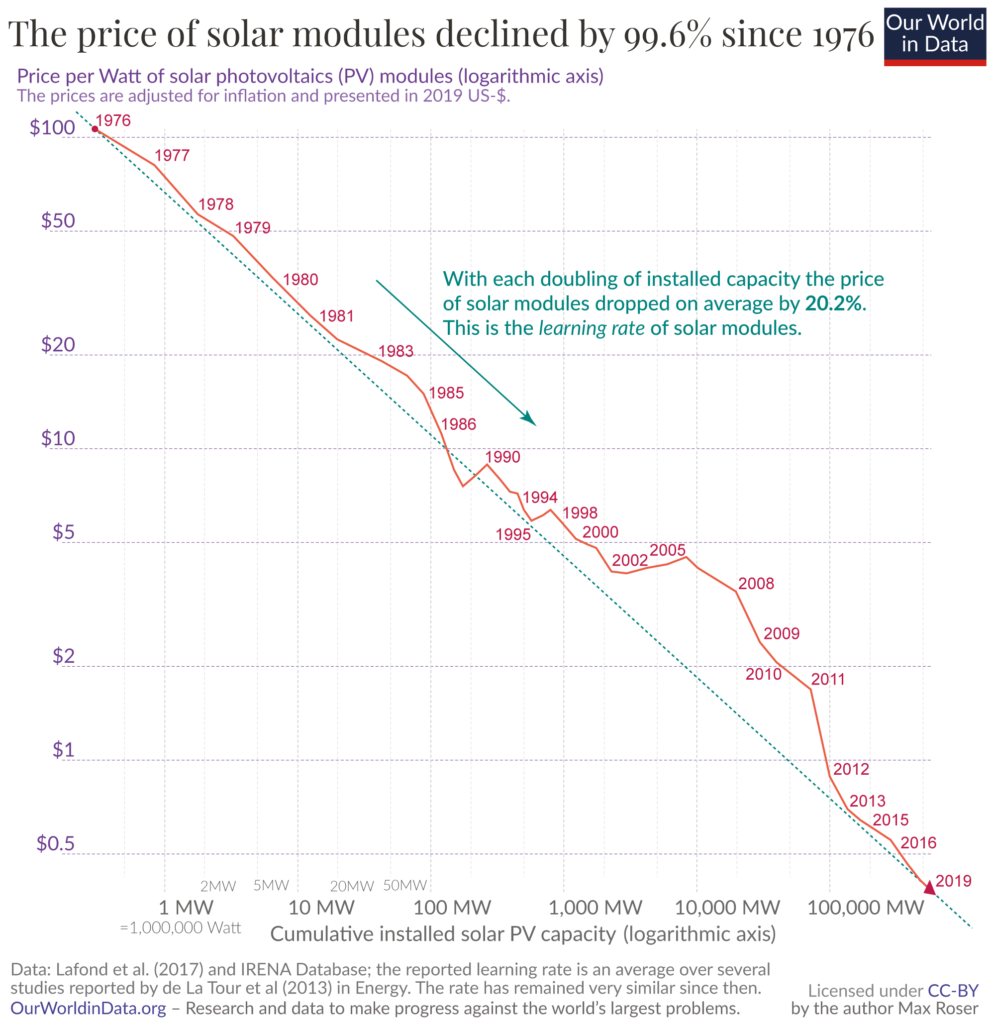

The key to learning is doing: the more you make, the better you get at making, which is why semiconductors have a downward sloping learning curve. As production volumes increase, cost falls and falls and falls.

That in turn means that if you want to produce the difficult-to-make things that render countries rich and powerful, the opposite of free trade dogma is required: you must shut out foreign competition, freeing up domestic demand for your native industries, so that those industries can ramp up supply and start marching down the learning curve.

If you don’t do that, then your domestic market will buy from foreign producers, helping them learn, not you.

Of course, too much protection can also be a problem. If your domestic industries are not subject to competitive pressures, they won’t have an incentive to learn. That can particularly vex small countries whose internal demand can only support one or two firms in a given market. But for a country the size of China, that’s not a problem. (Indeed, it’s no accident that free trade ideology has roots in Western Europe, home to lots of small- and medium-sized countries.)

So by picking fights with the West at a moment in its development when it has plenty of domestic demand for semiconductors (think Huawei) China is really just binding itself to the mast: committing its domestic market to its native semiconductor operations. It is forcing itself to learn.

And China does know how to learn. America installed the first solar panel in 1956, on the Vanguard I satellite. But at that time a single panel cost the equivalent of $500,000 today, meaning that we weren’t very good at applying the technology. As we made more solar panels, however, we got much better, as the solar learning curve below shows. But by the early 2000s learning had stagnated at around $5 per module.

Then China, which is energy poor but for coal—a mature technology that promises few gains from innovation—embraced solar, installing panels across its vast peripheral deserts.

By doing, China learned to do better, driving price south of 50 cents per module by 2019, making solar power the cheapest in the world today, more so even than coal or gas, and coming to dominate the global solar industry.

Will China walk just as quickly down the semiconductor learning curve? You can bet on it. And the country’s leadership in the new technology of quantum computing—the future of chips—means that it is not starting all that far behind its global competitors.

So when the Wall Street Journal says things like this:

Beijing is essentially now engaged in a massive, long-shot attempt to build from the ground up an advanced semiconductor manufacturing capability that doesn’t depend on foreign suppliers—churning through gargantuan amounts of the Chinese people’s money in the process. Rather than trying to reinvent the wheel, a better economic strategy would be to mend its relations with the West and reform China’s dysfunctional credit system—then import chips and let Chinese markets and Chinese companies decide what China is really good at.

Nathaniel Taplin, China’s State Capitalism Collides With Its Technological Ambitions, Wall St. J. (Jan. 2, 2021).

I have to wonder at its lack of learning.

And as I have pointed out elsewhere, the really funny thing about this mode of thought—the notion that a country is better off not trying to do the things that it is not right now good at doing—is that those who love it most also tend to be those who, when they turn their gaze to domestic markets, talk most about innovation and learning, and the need to protect firms from too much competition in order to promote them.

They argue in favor of monopoly and against regulation at home on the ground that shelter from competition is a necessary reward for innovation, that though big firms may destroy “static competition”—competition over price by firms with fixed levels of technical skill—doing so actually enables “dynamic competition”—competition to learn and innovate that eventually leads to far greater benefits for society.

So they ought to know better than to assume that a new Chinese closed door policy will save America from China.

Indeed, the Journal’s faith in free trade reminds me a bit of Ah Q, the eponymous antihero of The True Story of Ah Q, by the great early 20th century Chinese writer Lu Xun.

Ah Q’s talent, you see, was convincing himself he was the winner whenever he lost a fight.

To be sure, Ah Q was a metaphor for the much-oppressed China of a century ago, whereas America is still on top today.

But mentality is fate.