The Great Dying deconcentrated markets:

The complexity of an ecosystem can be estimated by the relative number of species: if a handful of species dominate, and the rest carve out a marginal existence, then the ecosystem is said to be simple. But if large numbers of species coexist together in similar numbers, then the ecosystem is far more complex, with a much wider web of interactions between species. By totting up the number of species living together at any one time in the fossil record, it’s possible to come up with an “index” of complexity, and the results are somewhat surprising. Rather than a gradual accrual of complexity over time, it seems that there was a sudden gearshift after the great Permian extinction. Before the extinction, for some 300 million years, marine ecosystems had been split roughly fifty-fifty between the simple and complex; afterwards, complex systems outweighed simple ones by three to one, a stable and persistent change that has lasted another 250 million years to this day. So rather than gradual change there was a sudden switch. Why?

According to paleontologist Peter Wagner, at the Field Museum of Natural History in Chicago, the answer is the spread of motile organisms. The shift took the oceans from a world that was largely anchored to the spot — lamp-shells, sea lilies, and so on, filtering food for meager low-energy living — to a new, more active world, dominated by animals that move around, even if as inchingly as snails, urchins and crabs. Plenty of animals moved around before the extinction, of course, but only afterwards did they become dominant. Why this gearshift took place after the Permian mass extinction is unknown, but might perhaps relate to the greater “buffering” against the world that comes with a motile lifestyle. If you move around, you often encounter rapidly changing environments, and so you need greater physical resilience. So it could be that the more motile animals had an edge in surviving the drastic environmental changes that accompanied the apocalypse . . . . The doomed filter feeders had nothing to cushion them against the blow.

Nick Lane, Life Ascending: The Ten Great Inventions of Evolution 145-46 (2009).

There is much food for antitrust thought in evolutionary history if you think of firms as representing methods of extracting value from the consumer environment. That makes them like species, all the members of which tend to use the same methods of extracting value from the natural environment. One species of bird uses long bills to get worms. Another uses short bills. And so on.

The Advantage of Incumbency

The Great Dying teaches a number of lessons. First, like the Cretaceous–Paleogene extinction event about which I have written before, it suggests the advantages of incumbency. The fact that less motile organisms have not reattained their former dominant position in the 250 million years of relative competition that has prevailed since the Great Dying tells you that less motile organisms were not particularly competitive relative to motile organisms. And yet for the 300 million years until the Great Dying they dominated, despite the parallel existence of more motile organisms. Why? Perhaps simply because they evolved first.

Industrial organization economists have long warned about these “first-mover advantages,” but the antitrust laws ignore them. The “conduct requirement” in antitrust holds that simply being dominant is not an offense in itself. There are plenty of good reasons for that rule, because it’s easy to use it to punish justified market success. But one bad reason to support the rule is that the dominant firm is always the better firm. If the history of the Great Dying is any guide, incumbency does sometimes protect uncompetitive firms.

Competition’s Good Side or The Virtue of Theft

The Great Dying’s second lesson for antitrust has to do with motility, for motility means, at least in part, predation and theft. Creatures that move can seek out new environments not yet colonized by stationary organisms feeding off minerals or sunlight. But one of the major things that motile organisms also do is to predate. Motility lets you range across the environment eating the organisms that have done the hard work for you of generating energy from light and inanimate matter.

We think of theft as being a problem in the law. We like to say that theft reduces incentives for innovation and economic growth because it means that innovators can’t fully reap the fruits of their productive labors. The plant that has a leaf torn off by some vicious armored predator has done the environmentally-friendly work of converting light to energy without so much as emitting a single carbon atom, and yet here the fruits of its labors have been stolen from it. Fortunately, we say, in the business context the law is there to stop such theft.

But the fact that the flourishing of motility after the Great Dying was correlated with an increase in ecosystem complexity—a reduction in species dominance—suggests that theft is not necessarily bad, at least if deconcentration of markets is your thing.

This is a familiar point, approached from a different angle. Industrial organization scholars have long pointed out that the strength of intellectual property protection matters. Make the patent term too lengthy and innovation will fall below optimal levels, because inventors won’t be able to build on prior art to create the next generation of inventions. It follows that if patent rights are too strong, then theft of intellectual property could actually lead to more innovation, and richer and more complex markets. Similarly, when a monopolist ties up a source of supply and uses it to suffocate competitors, theft would bring more competition to the market.

Antitrust recognizes the importance of theft for competition, although antitrust—probably wisely—doesn’t say so in quite such stark terms.

Every time antitrust enforcers order a dominant firm to supply an essential input to competitors—and antitrust does do that occasionally, even in the United States—antitrust is, objectively speaking, revising a property right. Which is to say: authorizing disadvantaged firms to steal from the dominant firm.

The nice thing is that when you’re the law you get to define the boundaries of the law, so you can plausibly say it’s not theft that you’re authorizing, but rather that the dominant firm’s ownership rights over the essential input never actually included the right to deny the input to competitors.

Regardless how it’s characterized, antitrust’s forced dealing remedy does allow other firms to take the fruits of the defendant’s labors, and for a price that must be less than their value, otherwise the taking would provide no competitive succor to the beneficiaries. That’s legalized predation in the biological sense. The aftermath of the Great Dying suggests that it’s probably justified, at least if the goal is to deconcentrate markets.

Competition’s Bad Side or The Horror of Predation

But at the same time, one must proceed with caution in celebrating the complexification of ecosystems that followed the Great Dying, because complexity and competition are not ends in themselves.

There’s a reason for which biologists also refer to the great age before any predators had evolved, the Ediacaran period, as the “Garden of the Ediacara.” We can view the rise of motility and predation, and the demise of filter feeder dominance after the Great Dying, as leading to a golden age of competition and complexity. It’s the golden age we live in today (or lived in until we started wiping out large parts of it starting with the end of the last ice age).

Or we can view the rise of motility and predation as destroying a peaceful Eden in which life competed principally on the virtuous project of converting the inanimate into the animate, of extracting energy from the physical environment, rather than from other living things.

From this perspective, if over the first 300 million years of the existence of complex life evolution tended to hit a wall, and for eons life did not get much better at converting the inanimate to the animate, then that says something about the limits of biology. It does not tell us that the motility, predation, and theft that followed represented an improvement.

From this perspective, the rise of motility and predation was instead a symptom of evolution’s defeat. When life could no longer advance by getting better at converting inanimate matter to animate matter, it turned on itself, leading to the hell of predator-prey competition that has characterized the past 250 million years. If only there had been a world government in the Ediacaran capable of enforcing the basic rules of criminal and property law!

Life would have stayed happy.

In general, the antitrust laws today are much more sympathetic to this dark view of predation than to the other. Antitrust enforcers for the most part shy away from revising property rights. And the legal system as a whole, of which antitrust is just a part, gives great priority to property. The natural world is, of course, the state of nature. And if there is one thing that separates civilization from the state of nature, it’s the concept of property, the notion that theft is to be curtailed, and that evolution within civilization is to take place along the old Ediacaran lines, with each attempting to better himself other than at the expense of others.

Over its first 300 million years, complex life does seem to have hit a wall in bettering itself through virtuous, non-predatory competition, at least so far as the biochemistry of energy production out of inanimate matter is concerned. Our inability to generate energy other than by burning fossil fuels shows that for all our own ingenuity we humans haven’t managed to outdo nature either. We live off the productive labors of other creatures, including both living plants and those dead so long as to have been ground into oil. That makes us, and the horror we have meant for the planet, the logical extreme end of the triumph of motility and predation after the Great Dying.

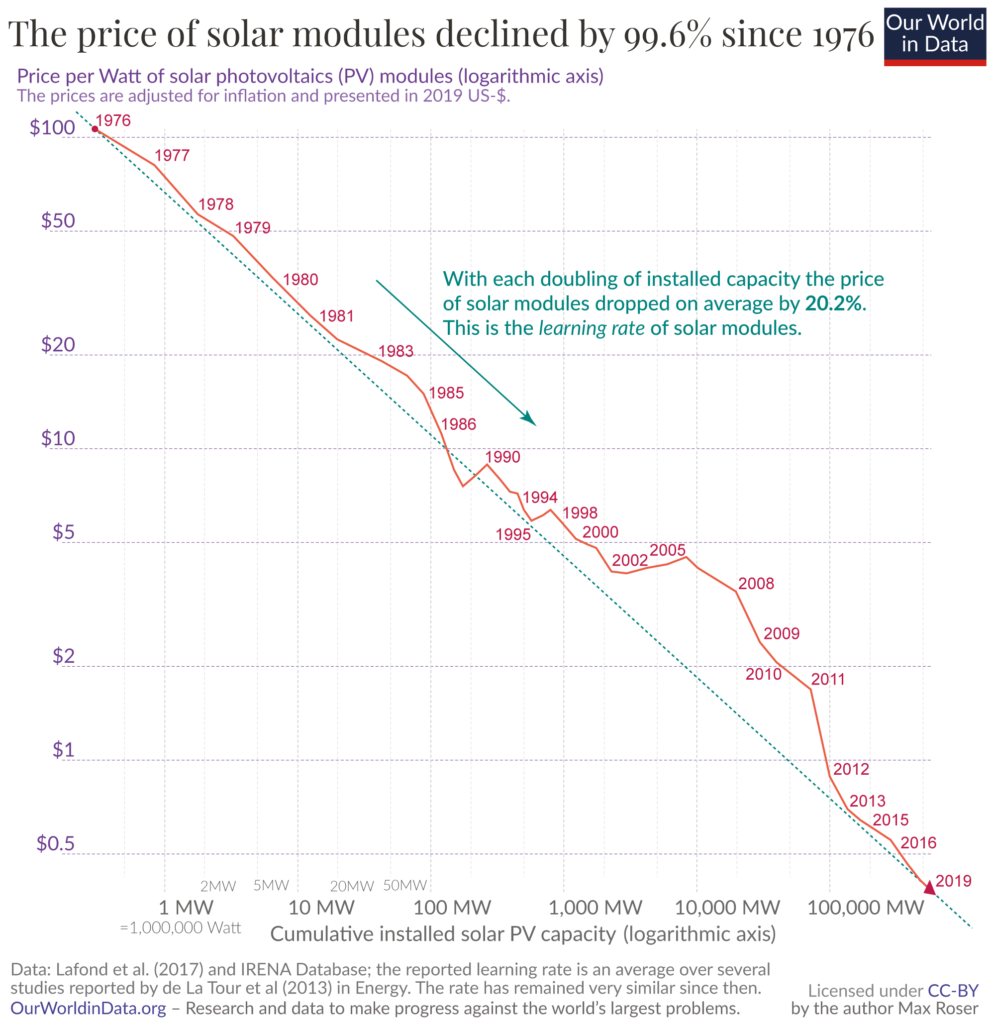

But the fact that civilization’s vision, honored however often in the breach, is fundamentally Ediacaran, suggests to me that there is hope. Climate disaster is effectively forcing us to extend the property laws we enforce within civilization to the life outside of it. With luck, the virtuous, non-predatory competition that results will help us achieve the breakthrough that life could not, and allow us to advance into new methods for generating energy from the inanimate.