It’s a good thing that The New York Times’ Food department hasn’t gotten the small-is-beautiful memo.

On the same day that the paper ran another flawed installment in its crusade against bigness, this time targeting Google for bringing competition to wireless-speaker-maker Sonos, the Times’ food section ran a paean to behemoths of the restaurant business–chains like IHOP and Applebee’s–that highlights many of the reasons why size is often a good thing, both for workers and consumers.

Sonos

Let’s start with the Times’s wrongheaded defense of Sonos.

As the paper did in an earlier defense of cloud-computing startup Elastic, the Times here continues to confuse harm to competitors with harm to competition. Google, the paper suggests, is competing unfairly with Sonos, by “flooding the market with cheap speakers that [Google] subsidize[s] because [the speakers] are not merely conduits for music, like Sonos’s devices, but rather another way to sell goods, show ads and collect data.”

The Times is talking about Home, Google’s answer to Amazon’s Echo, which includes a high-definition speaker that plays music, but also provides access to Assistant, Google’s AI-powered virtual assistant, which allows users to run internet searches, buy products, order food, and do much more by conversing with the speaker system.

The Times weeps that Sonos can’t turn a profit selling its speakers–which only play music–for less than $200, whereas Google sells Home for $50. The implication is that Google is engaged in predatory pricing–sales of products below their cost of production–for purposes of driving competitors from the market. That’s always possible in an abstract sense, and would be an antitrust violation if some other criteria were also met.

But there’s an obvious alternative explanation staring the Times in the face, one that doesn’t involve anticompetitive conduct: that Google isn’t in the market to sell speakers, Google is in the market to sell virtual assistants that also happen to play music.

And when you count up all the different ways Google is able to generate revenue from its product, including commissions Google earns on goods purchased through Home, revenues Google generates from selling ad-targeting services using the data generated by Home, and, of course the $50 purchase price of a Home unit itself, those revenues probably cover Google’s costs, including the cost of making the speakers that go into Home.

We don’t say that a hotel that offers guests free breakfast is engaged in predatory pricing designed to drive the local Starbucks out of business, even though a breakfast price of $0 is definitely below the cost of making the breakfast. Because the hotel is not selling breakfasts. The hotel is selling a package, and the hotel includes the cost of the breakfast in the price the hotel charges for the room. If the local Starbucks wants to compete, then either Howard Schultz needs to get into the hospitality business, or Starbucks needs to offer better coffee than the hotel. (Have you ever skipped out on a free breakfast to go somewhere better? I have.)

The same goes for Sonos. To beat Google, Sonos can try to field its own virtual assistant. Admittedly unlikely, but not a reason to condemn Google, for reasons to be discussed in a moment. Or Sonos can build better speakers than the ones Google bundles with Home, speakers that are enough better to make music lovers willing to choose them over, or in addition to, Home.

The Times makes much of the fact that Google may have used information Google collected from its partnership with Sonos to copy Sonos’s speakers. But as I have emphasized in relation to other reporting by the Times, copying is good for competition, not bad, and is certainly no antitrust violation. If Google copies Sonos’s speakers, making Google’s own as good as Sonos’s, that will have the competitive result of preventing Sonos from leveraging the superiority of its products to charge monopoly prices for them.

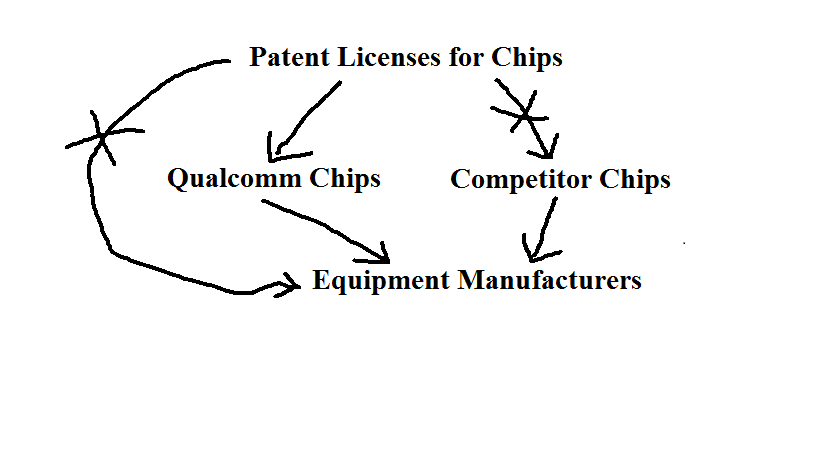

Of course, we want innovators to reap some rewards for innovating, which is why the patent laws prevent copying for a limited period of time. Sonos is suing Google for patent infringement, and if Google has infringed, then the court will award Sonos lost profits, as it should. But such patent litigation is about enabling firms to preserve the legislatively-sanctioned monopoly that is a patent on a desirable product. Patent litigation is not about preserving competition.

The Times also makes much of the fact that Sonos’s CEO confessed to being frightened about suing Google, because Google might respond by terminating a partnership with Sonos that allows Sonos owners to use their Sonos speakers, in lieu of Home, to communicate with Google’s Assistant.

But that’s just business. If Sonos postponed suing Google for patent infringement because Sonos wanted to continue to be able to have access to consumers wishing to buy virtual assistants, rather than just speakers, then Sonos was effectively licensing its speaker patents to Google at a price equal to the extra profits that Sonos was generating from the virtual assistant business. If Sonos is asserting its patents now, that means that Sonos thinks it can make more from court-ordered licensing than from the informal exchange of access to its technologies for access to Google’s Assistant.

Standing behind the Times’s article is the unspoken assumption that without the ability to offer access to virtual assistants through its speakers, Sonos is doomed, regardless how good its speakers may be, because consumers don’t care enough about great speakers to be willing to buy them in lieu of, or in addition to, speakers bundled with a virtual assistant, such as Google Home. That may be true, and sad for Sonos, but the ultimate cause must be that Sonos is simply less technically savvy than Google.

Google invested in the search and AI it needed to produce a virtual assistant. Sonos didn’t. True, Sonos may have pioneered wireless speaker technology that Google was not able to match without licensing that technology (informally so far, perhaps formally, under court order, in future) from Sonos. But Sonos could have taken the same tack against Google, reverse-engineering Google’s search algorithms and Assistant AI to create its own virtual assistant. If Sonos wasn’t able to do that, because it would have required too much time and money, then that’s evidence that what Google has achieved in search and AI is much more of a technological advance than are Sonos’s speakers.

Which takes us back to the basic point that to the extent that Sonos is failing to compete effectively against Google it’s because Google is doing a better job than Sonos at giving consumers what they want, not because Google is restraining competition. Once again, the Times has mistaken a textbook case of effective competition for an example of monopoly.

It’s also worth noting that Google has not actually yet retaliated by cutting Sonos off from access to Assistant, no doubt because Google recognizes that Sonos is better at making speakers than is Google, and Google can build its virtual assistant market share by reaching consumers who care about getting great speakers through Sonos.

That, too, is how markets are supposed to work. If Google can make its product better by combining it with rival technology, Google will do that. The fact that Sonos might not be able to survive without Google but Google can survive without Sonos means that Google can drive a hard bargain with Sonos and absorb most of the gains from trade. But Google can’t drive such a hard bargain as to make Sonos unwilling to go on, because then Google will lose the customers it can only get through Sonos.

That means that Sonos will not turn into the next tech giant. But with 1,500 employees and a billion dollars in annual sales (which the Times rather humorously tries to downplay as “a nice little business”), Sonos is doing just fine, even with the short end of the stick. We don’t all get to be the next tech fairy tale. (And if Google does pull the plug on its partnership with Sonos, the company can always compete to supply its speaker technology to Google for incorporation into Home. Indeed, Sonos’s patent suit may be a prelude to a transition into that new business model.)

The Times’ piece on Sonos is also a sobering reminder of the extent to which the paper’s business pages have become a mouthpiece for writers’ self-interested war on Google, Facebook, and Amazon, three companies that writers see as having tanked their earnings in recent years, as I have argued in depth elsewhere.

It’s not just the rhetoric that belongs more comfortably in a polemic than a news feature (Sonos is “under the thumb of Big Tech,” according to the Times). It’s also the sourcing.

The Times tells us that “congressional staff members have discussed [Sonos CEO Patrick Spence’s] testifying to the House antitrust subcommittee soon about his company’s issues with them,” but fails to mention that those hearings have been convened by a Congressman who is simultaneously sponsoring legislation pushed by the News Media Alliance, an industry trade group, that would give newspapers an exemption from the antitrust laws. The Times also quotes an employee of the Open Markets Institute describing Sonos’s fear of Google as “real,” without revealing that Open Markets is run by a journalist with ties to an organization that advocates on behalf of writers. More on both connections here.

But do you think that the Times would care to ask an actual antitrust law scholar whether Google’s conduct is anticompetitive? Nuh-uh. The article couldn’t have been written more critically of Google if Open Markets, or the House antitrust subcommittee, had authored the article itself and issued it as a press release.

IHOP

Thank goodness neither Google, Facebook, nor Amazon is in the restaurant business. Because in that case it would be hard to imagine the Times publishing Priya Krishna’s recent love letter to massive chain restaurants, “Current Job: Award-Winning Chef. Education: University of IHOP.”

According to Krishna’s piece in the Times:

Chain restaurants are often accused of a sterile uniformity and a lack of attention to quality ingredients, nutrition and the environment. But for anyone trying to enter the restaurant business, they have particular attractions: formalized training, efficient operations, predictable schedules and corporate policies that claim to discourage the kind of abuses that have come to light in the #MeToo era. The pay is sometimes better than at independent restaurants, and the Affordable Care Act requires companies with 50 or more full-time employees to provide health insurance.

The article highlights several “acclaimed chefs [at independent restaurants] who prize the lessons they learned . . . in the scaled-up, streamlined world of chain restaurants,” from the influential chef who eats at Waffle House to Jacques Pepin, who spent ten years working at Howard Johnson’s.

Chain restaurants provide workplaces that are, it turns out, less heirarchical than independent restaurants. Because egalitarianism is more efficient. At Applebee’s, for example, there isn’t “a strict heirarchy . . . because the kitchen [isn’t] centered on a chef, as in many independent restaurants. ‘There is this understanding that every person is important to making the restaurant run smoothly . . . Nobody thought the dishwasher was a lower status than them.'”

According to the article, “[s]everal chefs point to rigorous customer-service standards of the chains where they worked. ‘It was pretty much that the customer is always right,'” said one chef, who observed to the Times that “[i]t’s a level of hospitality he doesn’t always see in fine-dining restaurants.”

Another chef reported having had to “make sacrifices: lower pay, or forgoing pay while training” when she moved to working at independent restaurants.

She also had to put up with abuse. The article quotes her as recalling that when it took her too long to run food to a table at an independent restaurant, “‘the chef threw a potato and it hit me in the head. . . . That kind of stuff doesn’t happen in a chain restaurants [sic] because of corporate structure. You tend to be treated more fairly.'”

Shortly after reading this article, I went to a small family-run butcher’s shop to get a thinly-sliced cut of meat that my wife needed for a dish she was preparing. The slicing machine was in a back room into which a small internal window had been cut. I could just make out through the glare that the butcher was handling the meat with his bare hands.

I didn’t complain, but I did make my next stop a Kroger’s, the largest grocery store chain in the world. Economics teaches that if this firm were a monopoly, it should have lower quality standards than firms on the competitive fringe, like the family-owned butcher shop I had just left. I went to the meat section and asked for the same cut. The slicing machines were all directly behind the counter, in full view of customers. And the first thing the butcher did was to put on some gloves. True, he wasn’t as friendly as the folks in the family store. But when I got home, I gave only the cuts from Kroger’s to my wife. Big is not always bad.

Small businesses are a good thing, in my view, but only when they are actually better than big businesses. Thousands of independent restaurants survive, particularly in the luxury space, despite treating their labor less well than do the chains, because they provide a shot at top-chef fame for employees and a unique dining experience for customers that chains haven’t yet been able to match. The success of independent coffee shops in resisting Starbucks by taking coffee connoisseurship to another level is also a great example.

But when a smaller firm fields a product that isn’t better than what its rival has to offer, when a firm tries to sell speakers to consumers who would rather buy speakers-plus-virtual-assistants, the solution is not to try to use the antitrust laws to shelter the smaller firm.

The solution is to let the company up its game, or clear out.