One hears constantly about the power of technology to enable the consumer-harmful practice of price discrimination, which is the charging, to each consumer of a given product, of a price equal to the maximum that the consumer is willing to pay for that product. But one hears very little about the power of technology to enable the consumer-beneficial practice of cost discrimination, which is the foisting upon each firm of a price equal to the minimum that firm is willing to accept in exchange for selling a given product.

That’s not because the technology isn’t there. In fact, because big business invested in supply chain automation long before the tech giants made possible the snooping needed to identify consumer willingness to pay, the technology needed for cost discrimination is more developed than the technology needed for price discrimination. The reason we don’t hear about cost discrimination is that the technology needed to implement it is in the hands of firms, rather than the consumers who would benefit from cost discrimination.

This state of affairs isn’t surprising, since firms are few relative to consumers, and therefore more likely to have the pooled resources and capacity for unified action needed to invest in and implement a discrimination scheme. Yes, consumers have review websites, and price aggregators, but that’s a far cry from the centralized acquisition and analysis of data, and the ability to bargain as a unit based upon it, that firms enjoy.

One way for consumers to implement cost discrimination would be by organizing themselves into data-savvy cooperatives for purposes of negotiating prices with firms. Another would be for startups to step in as middlemen, taking a cut from consumers in exchange for engaging in data-based bargaining on their behalf.

But another solution is for the government to create an administrative agency with the power to regulate consumer prices. It turns out that there is ample precedent for government price regulators to dictate cost-discriminatory prices.

Here, for example, is an account of the Federal Power Commission doing just that for wellhead natural gas rates in 1965:

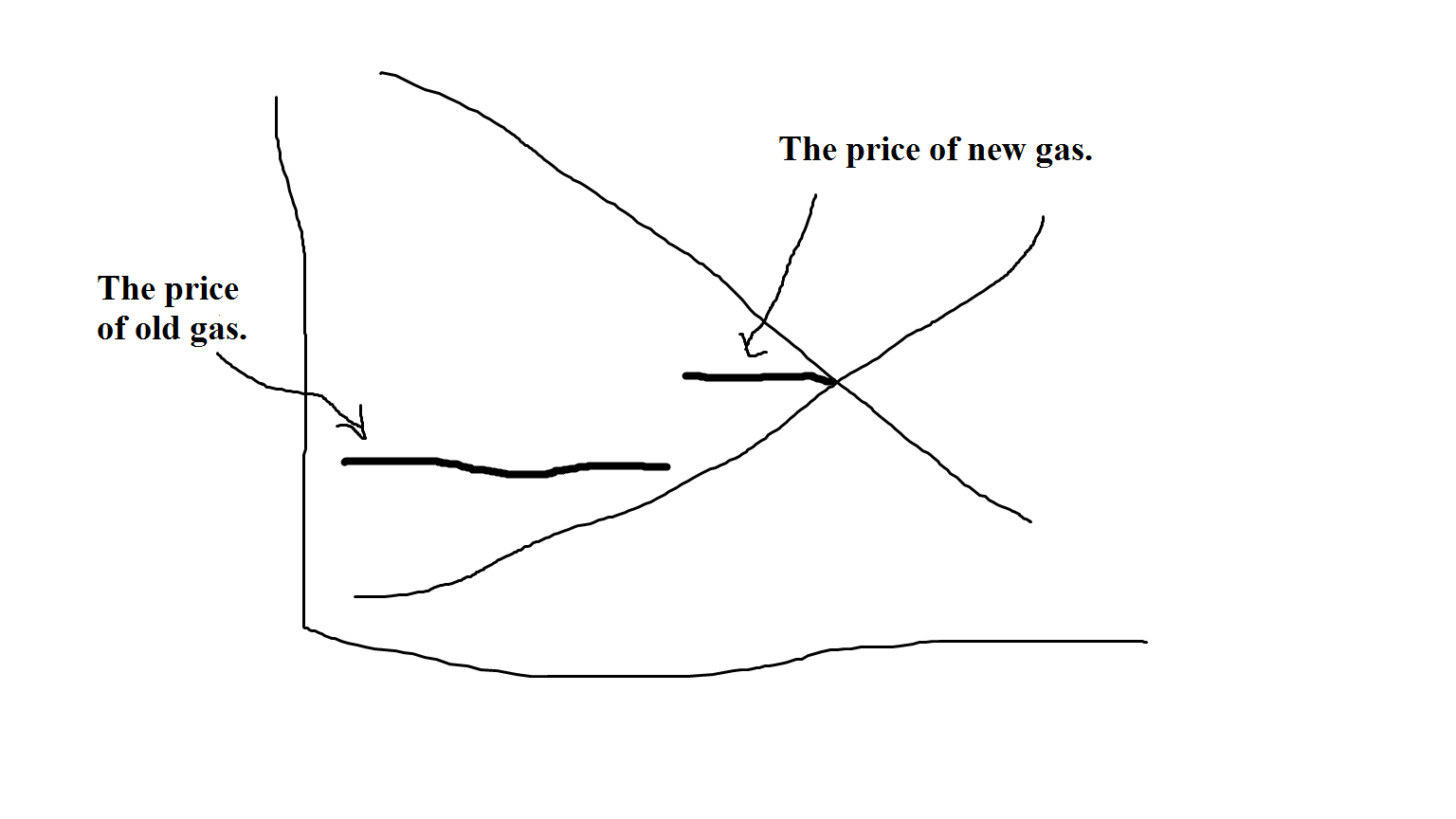

Pricing designed to encourage supply could also create “economic rents” (profits above a normal return) for gas producers with old, inexpensive reserves. Neither the producers’ brief for fair field prices nor the staff’s preference for rates based on average historical costs seemed acceptable or sufficient. It was the young economist Alfred Kahn, serving as an expert witness, who suggested a two-tied pricing structure: separate prices for old gas and new gas. Here, from the commission’s perspective, was an ideal political, and perhaps economic, solution. “The two-price system,” wrote the commission, “thus holds out a reward to encourage producers to engage in further exploration and development while preventing excess and unnecessary revenues from the sale of gar developed at a period when there was no special exploratory activity directed to gas discovery.”

Richard H.K. Vietor, Contrived Competition: Regulation and Deregulation in America 113-14 (1994).

The old gas here corresponds to inframarginal units of production and the new gas corresponds to marginal units of production. Economists were once acutely aware of the problem that even under perfect competition the inframarginal units can enjoy a windfall at the competitive price, so long as the cost to their owners of producing those units happens to be below the cost of the marginal units, which determine the competitive price.

David Ricardo famously explained all of English aristocratic wealth in these terms. The aristocrats take the best land by force, he observed, and cultivation of that land is relatively inexpensive, because it is the best land. The rest take land that is more expensive to cultivate. Because the competitive price for agricultural goods must be high enough to pay the higher cost of cultivating the poorer-quality, hence marginal, land, the price must then be above the cost to the aristocracy of cultivating the best land, leaving the aristocracy with great profits.

Just so, the FPC worried that the producers of the old gas, who had come upon the gas only as an accident as part of explorations for oil, and therefore had incurred a gas exploration cost of zero, would enjoy a windfall if prices were set to cover the costs of bringing new gas from the ground through dedicated and costly explorations. So the FPC approved prices that discriminated against the old gas producers based on their lower exploration costs.

Consumers don’t know enough about the costs incurred by the firms that sell to them to insist on low prices when buying from firms with low costs. Which is why I suspect that government price regulation will be the only way for consumers eventually to enjoy some of the pricing-based fruits of the information age.

One reply on “Cost Discrimination”

[…] the White Paper Guidelines for AI Procurement…Albert Sanchez-Graells(How to Crack a Nut) Cost DiscriminationOne hears constantly about the power of technology to enable price discrimination, which is the […]