Today’s antitrust movement loves to point to the breakup of AT&T as an example of what antitrust enforcers can do when they put their minds to it. The only problem is that the breakup of AT&T was a disaster, and The Wall Street Journal has kindly provided a new example of that today: robocalls.

The breakup of AT&T was a politically-motivated hit, a Nixon-originated project that became the only monopolization case carried through to a conclusion by a Reagan Justice Department that otherwise wanted nothing else to do with antitrust. The target was widely recognized as the standard bearer of progressive managerialism and a leader in progressive labor practices. (Remind you of some other firms that have found themselves in the cross-hairs of an otherwise do-nothing Antitrust Division today?)

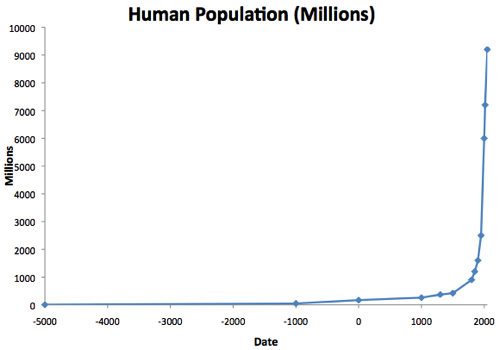

The country has little to show for the breakup forty years later. It didn’t eliminate the fundamental bottleneck associated with telephony: the massive last-mile infrastructure required to get calls into consumers’ handsets. That infrastructure is today mostly owned by just three firms, the new AT&T, Verizon, and T-Mobile, because it exhibits great economies of scale.

While the breakup did bring down long-distance rates, that’s a bug, not a feature. The only reason the old AT&T charged high long-distance rates was because the company was engaged in progressive redistribution of wealth, scalping businesses and well-off long-distance powerusers to the end of providing dirt-cheap local phone access and “universal service” to the masses.

Any economist who knows his Ramsey prices will tell you that’s not the most profitable way to set your rates, because long-distance calling is a luxury, but basic phone access is a necessity (911, anyone?). To get the most profit out of the public, you want to charge high prices for the necessity–because people will pay those prices whatever they may be–and low prices for the luxury. The trouble with that from the perspective of distributive justice is that it’s a regressive rate structure: charging the masses high prices and elites low prices.

Which is just what happened after the breakup of Ma Bell.

The court and later Congress forced the Baby Bells that owned the last-mile infrastructure to connect long-distance carriers’ calls, enabling massive entry into the long-distance market and driving down long-distance rates. But consumers don’t just pay for long distance, they also must pay for basic call connection that allows long-distance calls to reach consumers’ handsets.

The price of that went up, for everyone, not just long-distance callers, because the last mile remained a bottleneck, an infrastructure so expensive that few firms can survive in the market. Which is why the Baby Bells, which controlled that infrastructure, never went away.

Liberated from a dominating headquarters weaned on a New Deal politics that demanded the sacrifice of profits in favor of progressive pricing, the Baby Bells now charged whatever they wanted. At last they could enjoy whatever cream they might be able to skim from a public that needs phone service and has nowhere to go. The fact that they dominated regional markets, but not long-distance, gave them the political cover that hulking monopoly Ma Bell never had.

Free to grow fat, they matured into the tri-opoly we have today, one that has distinguished itself in its adherence to the maxim that the greatest reward of monopoly is a quiet life by supplying America with slower mobile internet service than almost any country in the developed world.

But at least we got competition in long distance, right? Now anyone with $10,000 in working capital and a closet to store some routers can be a long-distance provider. Isn’t that a win for local self-reliance?

More like a win for fraud and robocallers, according to the Journal, in a story about the “dozens of little-known carriers that serve as key conduits in America’s telecom system,” connecting robocalls that “in total bilked U.S. consumers out of at least $38 million in 2019.”

The Journal treads lightly here–after all it’s got as much to gain as any newspaper from the current antitrust campaign against the tech giants that have out-competed the paper for advertising revenue in recent years–but it’s hard to disguise the culprit:

These small carriers took hold in the decades following the 1984 breakup of AT&T’s phone system monopoly, which was designed to lower the costs of long-distance calls. They mushroomed during the introduction of internet-based calling services in the 2000s.

The emergence of these small phone companies was in many ways a positive development for consumers who now pay less for long-distance calls. The downside is that the system wasn’t designed to discern between legitimate and illegitimate calls, which are sometimes mixed together as they are passed along. U.S. regulators generally didn’t require these carriers to block calls and in some cases forbade them from doing so as a way of limiting anticompetitive behavior. Some telecommunications experts say that opened the door for smaller carriers to hustle business from robocallers, or simply turn a blind eye to suspect traffic.

Ryan Tracy & Sarah Krause, Where Robocalls Hide: the House Next Door, Wall Street Journal, August 15, 2020.

Would there have been robocalls if we still had Ma Bell? Unlikely for a company that was so obsessed with control over its network that it famously stamped “BELL SYSTEM PROPERTY – NOT FOR SALE” on every handset in America.

(I do have to admit, however, that another communications monopoly still with us today provides something of a counterexample. The largest category of mail delivered by the U.S. Postal Service is advertising.)